The Child Tax Credit is a vital source of financial aid for American families with children. This credit has just been increased, and it may greatly help low-income families. Since the expense of having a family continues to rise, this initiative was created to help parents out. Families that meet the requirements of the new rule will get up to $50000 for each kid under the age of six, and up to $half for every child aged six to seventeen. This is a significant increase over the prior credit, which was limited at $2,000. The credit may be refunded in its entirety for those who have no tax burden. People with lower incomes may not owe as much in taxes.

Eligibility Criteria

It would be best if you met these criteria to qualify for the Child Tax Credit:

Age

The kid can't turn 18 before the conclusion of the tax year. The child's birthday must be on or after January1, 2005 is for 2021 credit to apply.

Relationship

The child must be your son, daughter, foster child, stepchild, brother, half-sister, sister, stepbrother, stepsister, half-brother, or a descendant of any of the aforementioned (such as a grandchild, niece, or nephew).

Support

The kid must have been living with you for more than six months at this point. During this tax year, the kid must have lived with you for as least 183 days.

Citizenship

The minor kid must be a citizen, national, or legal permanent resident of the United States.

Income

Income limits apply to a credit. For the next 2021 tax year, the benefit phases out entirely for filers with modified adjusted gross income (MAGI) of $150,000 or more, falling to 25% for those who have MAGI of $112,500 or more, and finally disappearing entirely for those who have MAGI of $75,000. For single filers, the benefit is entirely phased out at a MAGI of $200,000; for those filing as head of household, the MAGI is $200,000; and for those filing as married filing jointly, the MAGI is $400,000.

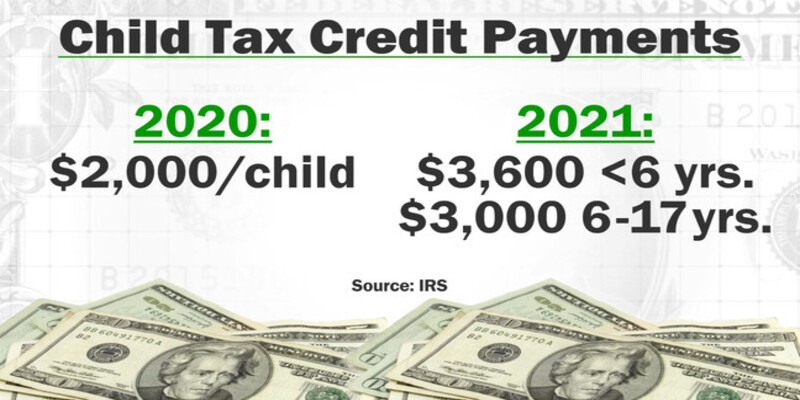

Payment Amounts

The maximum amount of the tax credit for kids has been raised from $3,000 to $6,000 for children aged six to seventeen. The credit may be refunded in its entirety for those who have no tax burden.

Monthly Payments

The Child Tax Credit for the tax year of 2021 will be paid in arrears in the form of monthly installments beginning in July and ending in December. The maximum monthly benefit for a family with a kid under the age of six is $300, while the maximum benefit for a family with a child aged 6 to seventeen is $250.

Lump Sum Payment

As an alternative to the monthly payments, you may be eligible to get the whole credit in a single payment when you complete your tax return.

How To Claim The Credit

In order to qualify for the Child Tax Credit, you must provide the following information on your tax return.

Child's Information

Name, Social Security number, and date of birth of the minor are required.

Relationship to Child

It's important to clarify your familial connection to the kid (whether as a parent, stepparent, grandmother, etc.).

Residence

If your kid lived with you for more than half of the tax year, you must indicate that.

Income

Providing your MAGI will determine whether or not you are eligible for the credit.

Conclusion

The tax credit for kids is a crucial resource for families in the United States because it provides financial assistance to help offset the expense of raising children. The most recent increase in the credit allows eligible families to earn up to $50000 per child under the age of six, and down to $3,000 for each additional child between the ages of six and seventeen. The credit is available, but only to those who meet certain income and other requirements. You should also know how and where to use the credit in your tax form to ensure you get the most refund at which you are eligible. Overall, the tax credit for kids is a valuable benefit that may have a major impact on the financial stability of low-income families that have kids.